|

The word concentration is frequently used in the financial world. Phrases like “you need to be more diversified to avoid concentration” or “you are over-concentrated in equities” are often thrown around by financial professionals, and for good reason, as concentration is a real risk. The issue, however, is these phrases likely pertain to concentration in an asset class, individual company, or some other related stock market investment. Such assessments are made with isolated information, instead of being examined from a holistic view point. Generally, concentration can be defined as “a close gathering of people or things”. Relating this to finance is easy. Take Bob, who has a $1,000,000 (the number of dollars is our “thing”) investment portfolio and $500,000 of that portfolio is invested in XYZ stock (the company Bob works for), and the rest is invested in mutual funds where his next largest position makes up $20,000 of the portfolio. Meaning 50% of Bob’s investment portfolio dollars (again our “things”) are gathered in one place. Based on the definition and information provided, anyone could conclude that Bob is highly concentrated in one investment, his company’s stock. However, all we have done is examined the total percentage of dollars that makes up one position in an investment portfolio. We have isolated our information to only one data set, a $1,000,000, instead of asking Bob about his entire financial picture. If we approached this concentration question with a new lens and asked Bob what other financial assets he has, it would reveal the following:

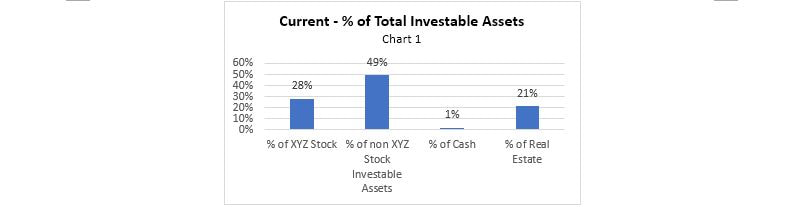

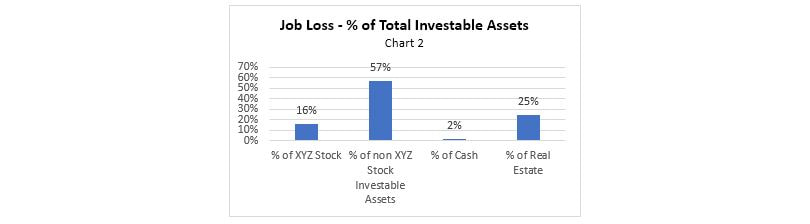

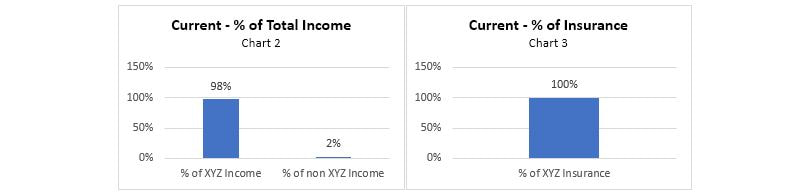

This new information begins to alter our thoughts on concentration. For example, in Chart 1[2] the percentage of XYZ stock[3] if compared to Bob’s total investable assets[4] is 28%, significantly lower than the 50% we derived from the limited information above and only 7% higher than his real estate holdings. In addition, we need to take into consideration that 50% of the 28% of XYZ stock is dependent on Bob not being terminated or leaving XYZ company in the next five years. Let’s look at what would happen if Bob did leave within five years. If Bob were to leave for any reason within that time frame, his concertation in XYZ stock would be 16% of his total investable assets. And his real estate holdings would be 25%! Furthermore, if we examine both Chart 2[5] and 3[6], we can see that much of Bob’s income is being derived from XYZ company, which is typical, but he is solely dependent on XYZ company for life insurance. One can now conclude: yes, even if Bob were to leave for any reason in the next five years, he is still concentrated in XYZ stock. However, we have uncovered two other forms of concentration:

As we know, Bob’s example is fictitious, but it is a good representation of most Americans today. Many of us, regardless of income, are tied to our employers. And as we move up the ranks and begin to receive raises and more complex compensation packages, this concentration and dependency can worsen. As our income rises so too does our cost of living; this phenomenon is called lifestyle inflation. If we succumb to this type of behavior, we may never be able to get away from the concentration of our employers. Furthermore, real estate is always a hot topic when speaking with individuals; it’s a tangible asset people can touch, feel, and enjoy (a far cry from owning a company’s stock) leading them to want more of it. However, just like Bob, it is often missed that the majority of households already have a large concentration in real estate through their own primary residence. If one were to continue to spend their money on real estate property, they may not realize the amount of money they have tied up in an asset that can be highly illiquid. Taking a holistic approach to concentration can uncover risks and opportunities that may have been hidden without further dissection. If approached this way, one can begin to make educated financial decisions that will positively affect their entire financial picture. It allows us to see where our true exposure is and if pressed with the question of, “Can I leave my job?” we know what is at stake and the holistic compensation package we would need to make the jump, instead of solely focusing on the salary we may receive. This awareness is crucial, as it puts an individual or household back in the driver’s seat to a healthy financial well-being. CLIFF HANGER – as the title sweuggests, this was part one of a two-part series. Next month we shift gears and discuss concentration as it pertains to investments and why concentration and less diversification within investable assets is not necessarily a bad thing; if you understand what your investing in…TO BE CONTINUED. Sincerely, LBW [1] This is a gross figure. [2] LBW Wealth Management [3] Includes both current and future XYZ stock amounts (total $1,000,000). [4] Includes Investment portfolio, 401(k), Primary Residence equity, Rental Property equity, and Cash. [5] LBW Wealth Management [6] LBW Wealth Management [7] To keep this example short and sweet, other items that may tie Bob to XYZ company would be health insurance, disability insurance, 401(k) match, etc. In addition, we need to keep in mind that if Bob were to leave XYZ company his new job may provide similar benefits. If they don’t or their benefits are significantly worse, Bob may have a tough time finding new employment. [8] Ceteris paribus. Comments are closed.

|

Archives

June 2018

DisclaimersCopyright © 2018 Leach, Bickmore & Weiss Wealth Management, LLC. All rights reserved.

|

RSS Feed

RSS Feed